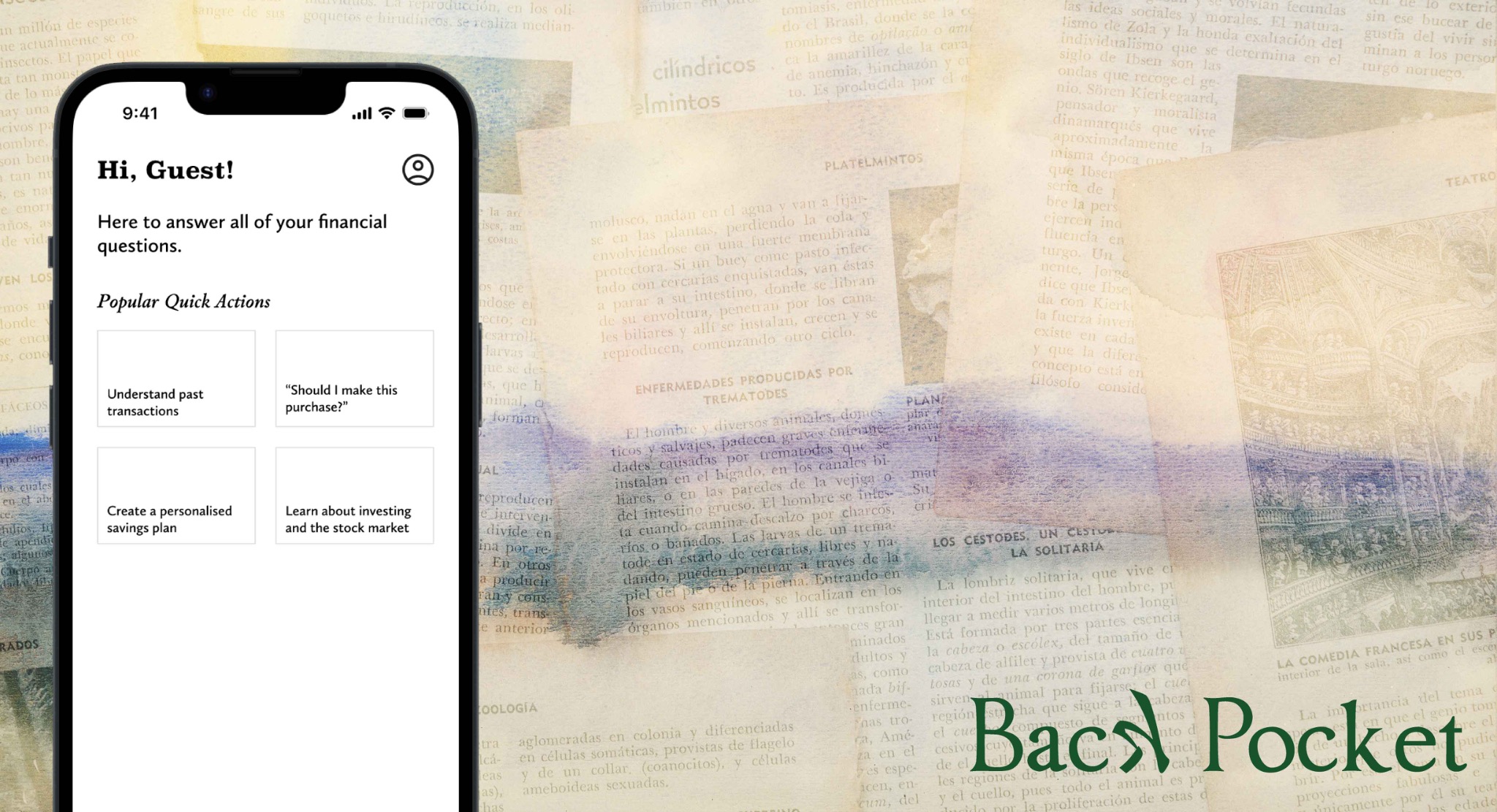

A Comprehensive Artificial Intelligence (AI) Assistive Tool for Everyday Finance

Introduction

In Artificial Intelligence for Media course at Loyola College, we were advised to complete a project based on how artificial intelligence can be useful to people on a day-to-day basis, especially when results based on LLMs can be faulty and incorrect at times.

This project highlights how finance is abundant with a lot of advice but is hard to follow by the general public. The solution should act as an extensive hand to the user, guiding them through complex money-related queries.

Tools + Software Used

Design Methodology

Discover → Define → Design → Deliver

The Double Diamond Process

Problem Statement

By creating this statement, the project gets a sense of direction for both research and design.

- User: Middle class families

- Need: Managing their spending habits

- Goal: Feeling empowered in their spending power

“What can I do to help middle class families manage their spending habits to make them feel empowered in their spending power?”

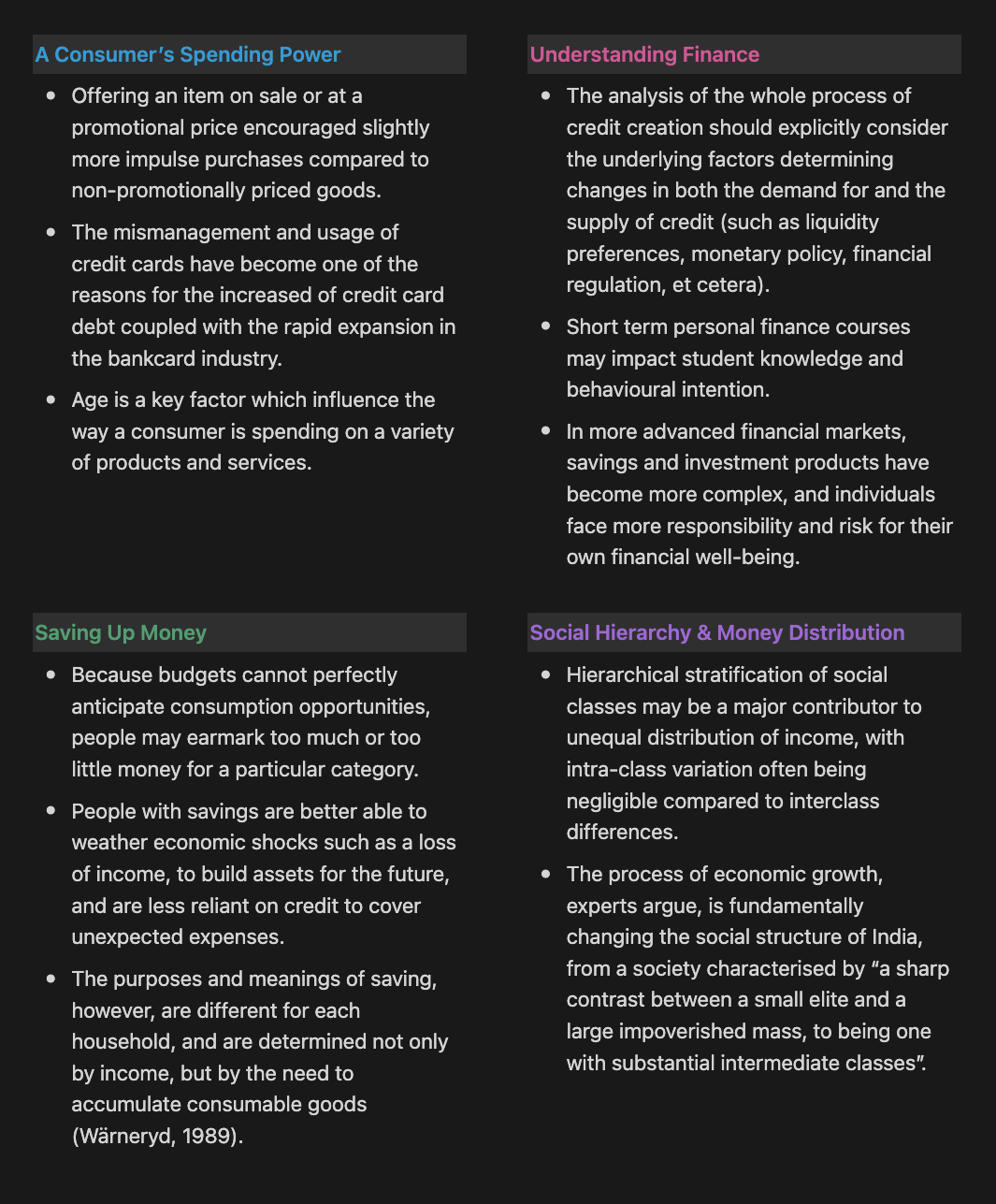

Readings

The readings are done to collect proper, evidence-based preliminary insights for how the project can be shaped. The research is from peer-reviewed papers and verified websites, and can be divided into two sections, theoretical and statistical.

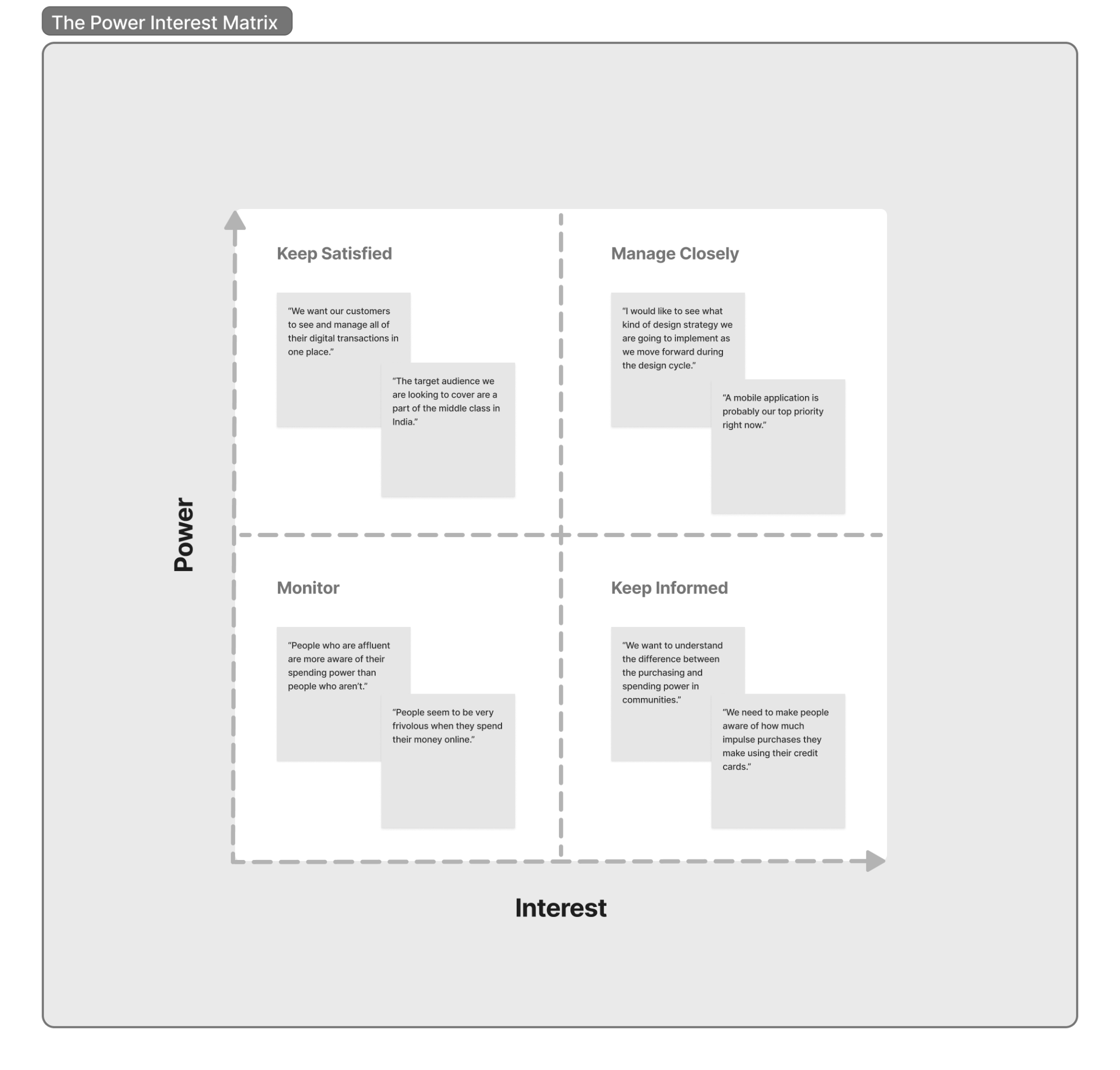

The Power Interest Matrix

With this method, the prioritisation of what is required for the project is analysed and assigned accordingly. It is arranged in the order of delivery severity.

Business Questions to Human Questions

For most statements that are based in succumbing to a business goal, the conversions makes the approaches more grounded and empathy-based.

- “We want our customers to see and manage all of their digital transactions in one place.” ➝ “How do people feel when they make their money transactions digital?”

- “The target audience we are looking to cover are a part of the middle class in India.” ➝ “How is the financial literacy for middle class households in India?”

- “People who are affluent are more aware of their spending power than people who aren’t.” ➝ “What are the ways in which money affects a person’s spending power in society?”

- “People seem to be very frivolous when they spend their money online.” ➝ “Is carelessness a part of unbridled spending and does it push poor financial decisions?”

- “We want to understand the difference between the purchasing and spending power in communities.” ➝ “Does hierarchy based on money in Indian societies affect how much of financial control a person possess?”

- “We need to make people aware of how much impulse purchases they make using their credit cards.” ➝ “Do credit cards promote impulse purchasing as a lifestyle?”

Interviews

Participants: 7

To dive deeper into the preliminary reasonings, it is not enough to just read and review material; Interviews are conducted with participants who are willing to give real-life insights into how the public perceives the topic.

Questions:

- What do you like the most about owning a credit card?

- What are some of the ways you make / access money?

- What do you think about digital modes of payment as a whole?

- Do you feel safe using digital modes of payment?

- Which is your most preferred mode of payment?

- How significant is money in your life?

- Have you ever taken a loan?

- Do you invest in stocks?

- How would you describe the financial severity of extra charges incurred using credit?

- What are some of the ways you save money for the future?

- What do you think is the best asset to save money with?

- Credit vs Debit — Which do you rely on more and why?

- Do you budget your money monthly / annually?

- Who do you get financial advice from?

- “Credit offered by financial services aren’t beneficial.” Do you agree / disagree with this statement?

- “It is very easy to make a living nowadays.” Do you agree / disagree with this statement?

- “I like spending a lot on events, celebrations and gifts.” Do you agree / disagree with this statement?

- If you have a money deficit in your household, how do you manage the risks that comes with it?

- What were your salary expectations when searching for your last role / job?

- What is your ideal dream purchase if credit wasn’t an issue?

- When was the last time you made a big purchase?

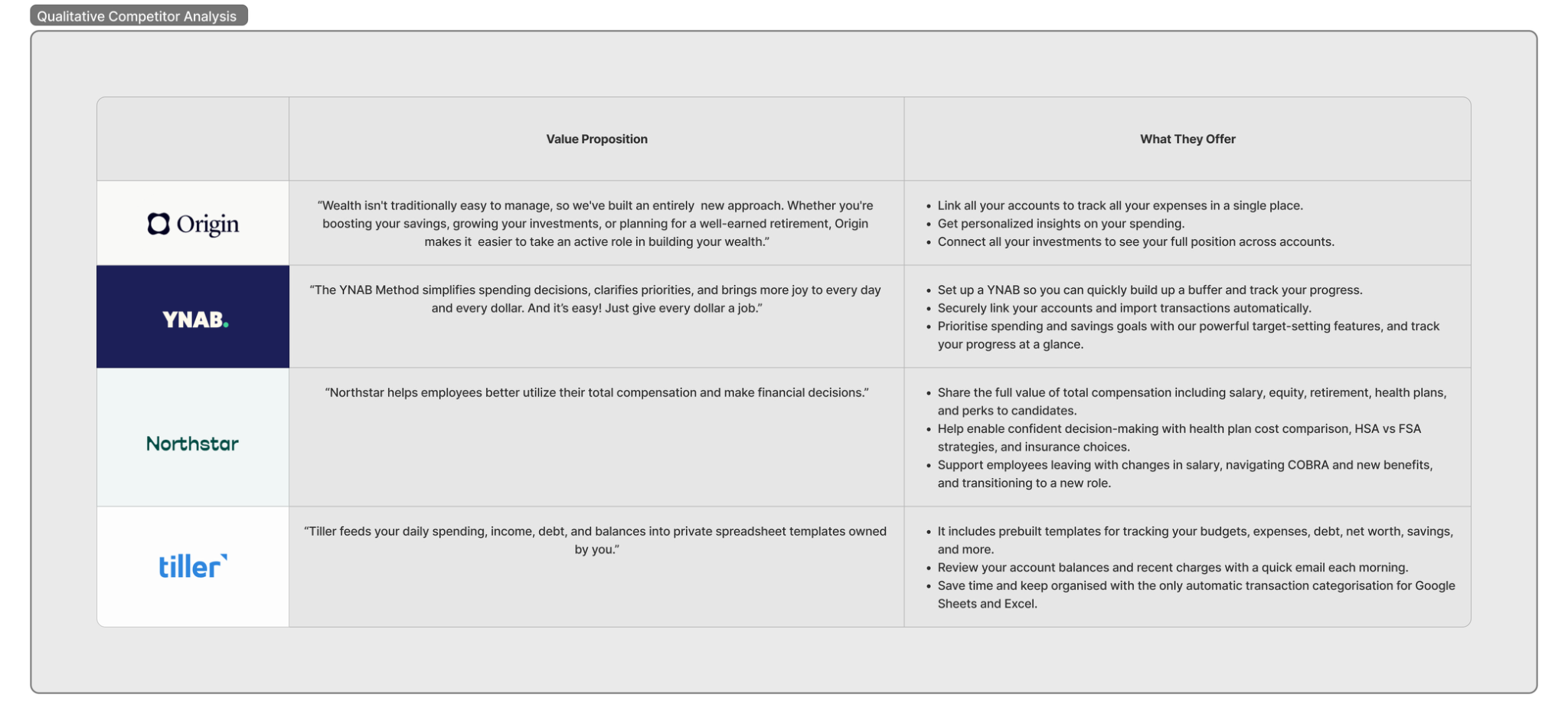

Qualitative Competitor Analysis

This method is based on analysing and describing different companies based on their offerings and what they bring to the table.

Thematic Analysis

From all of the data collected so far, themes are deciphered and the contents are labelled into the appropriate sections.

Insights

The final insights from the entire research done on the topic are as follows:

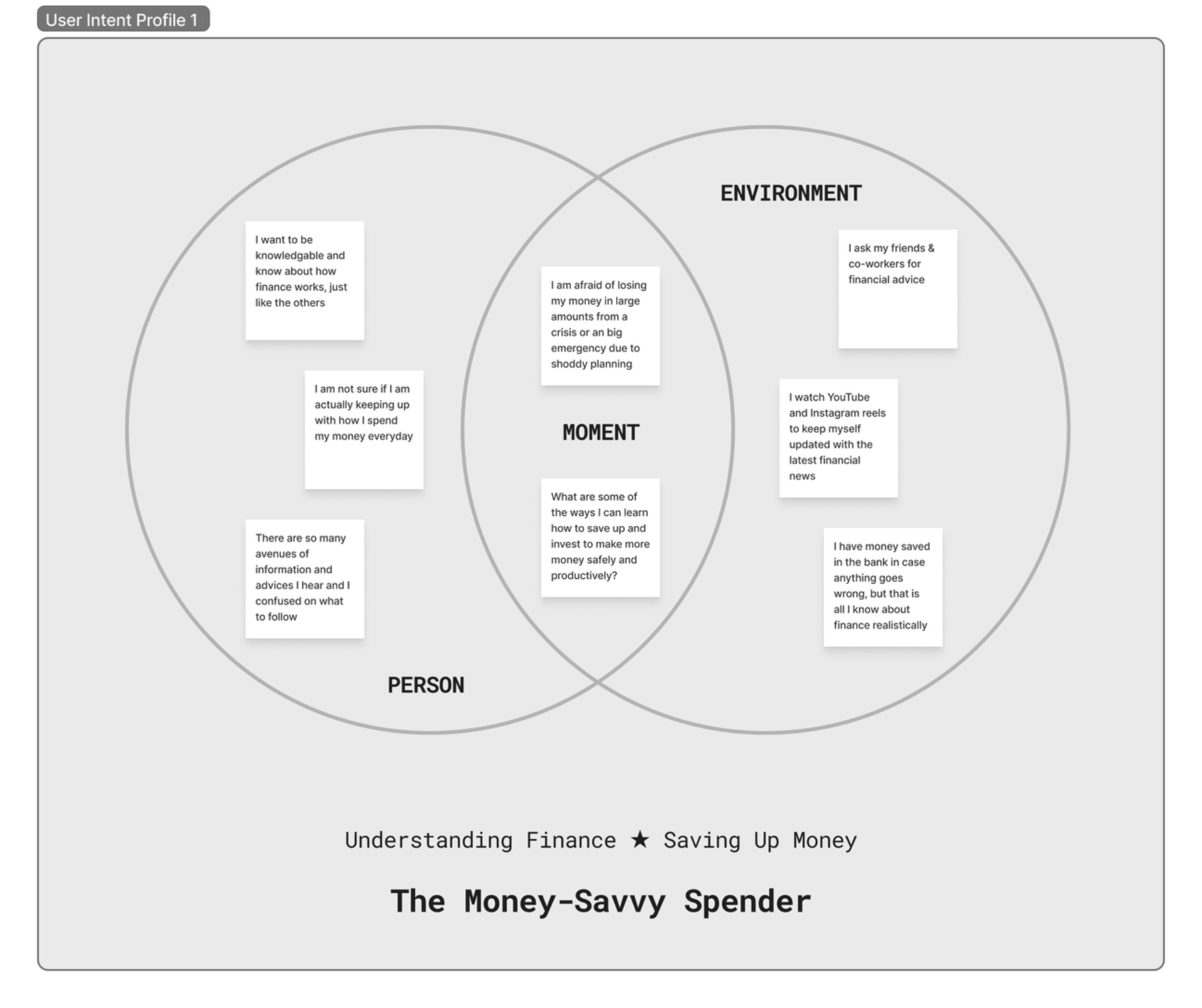

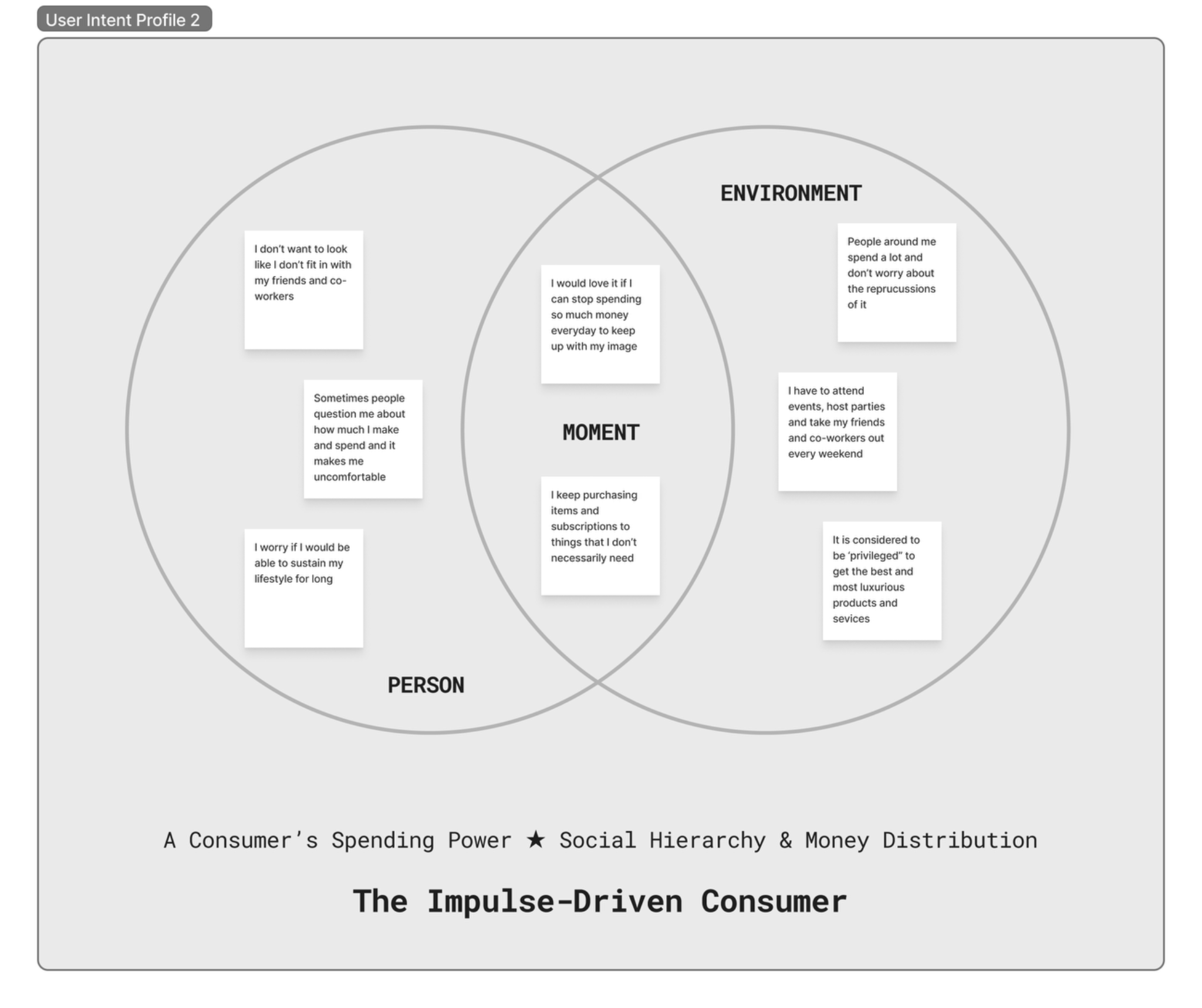

User Intent Personas

Using the insights, two profiles related to the main topic are created:

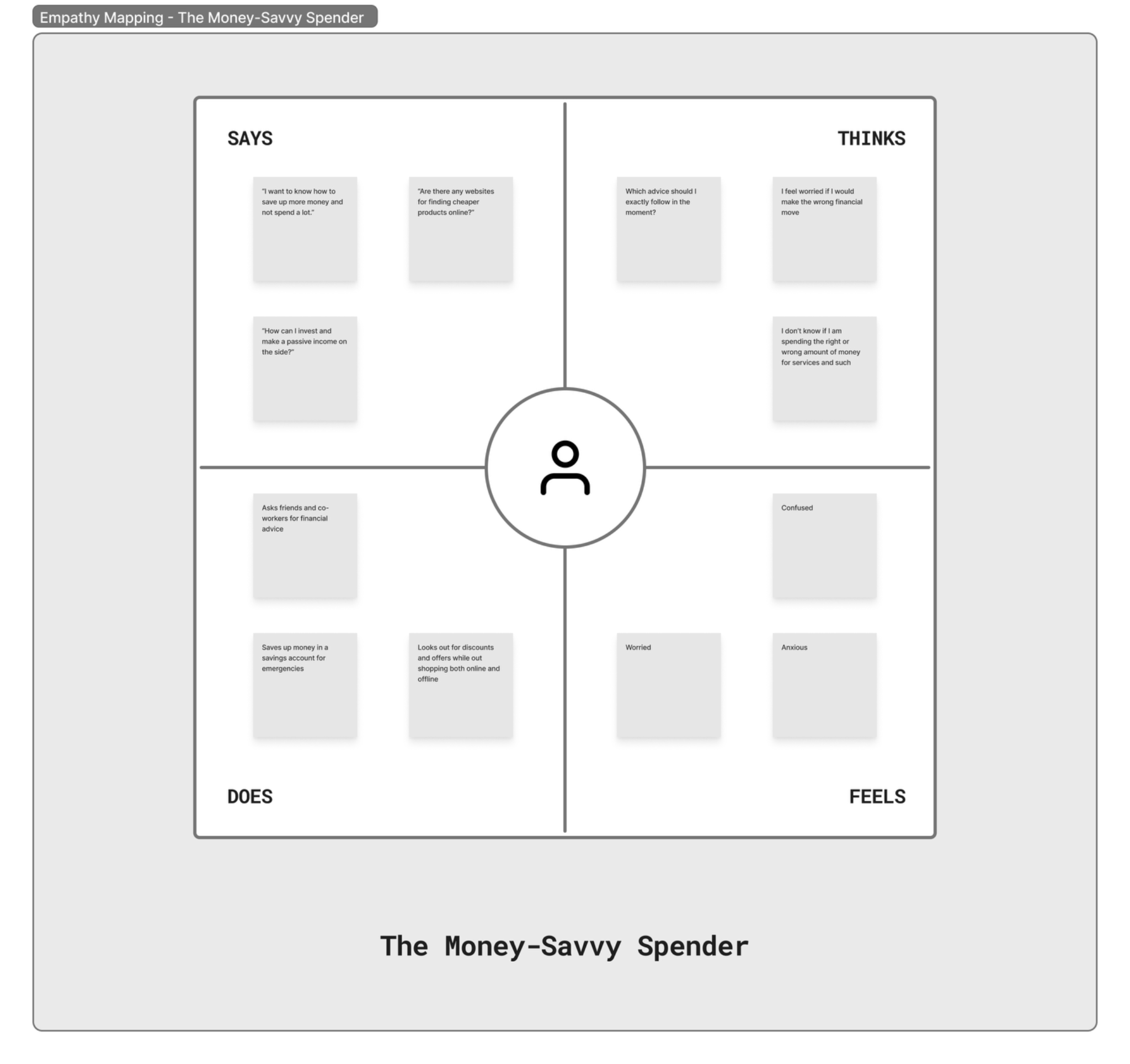

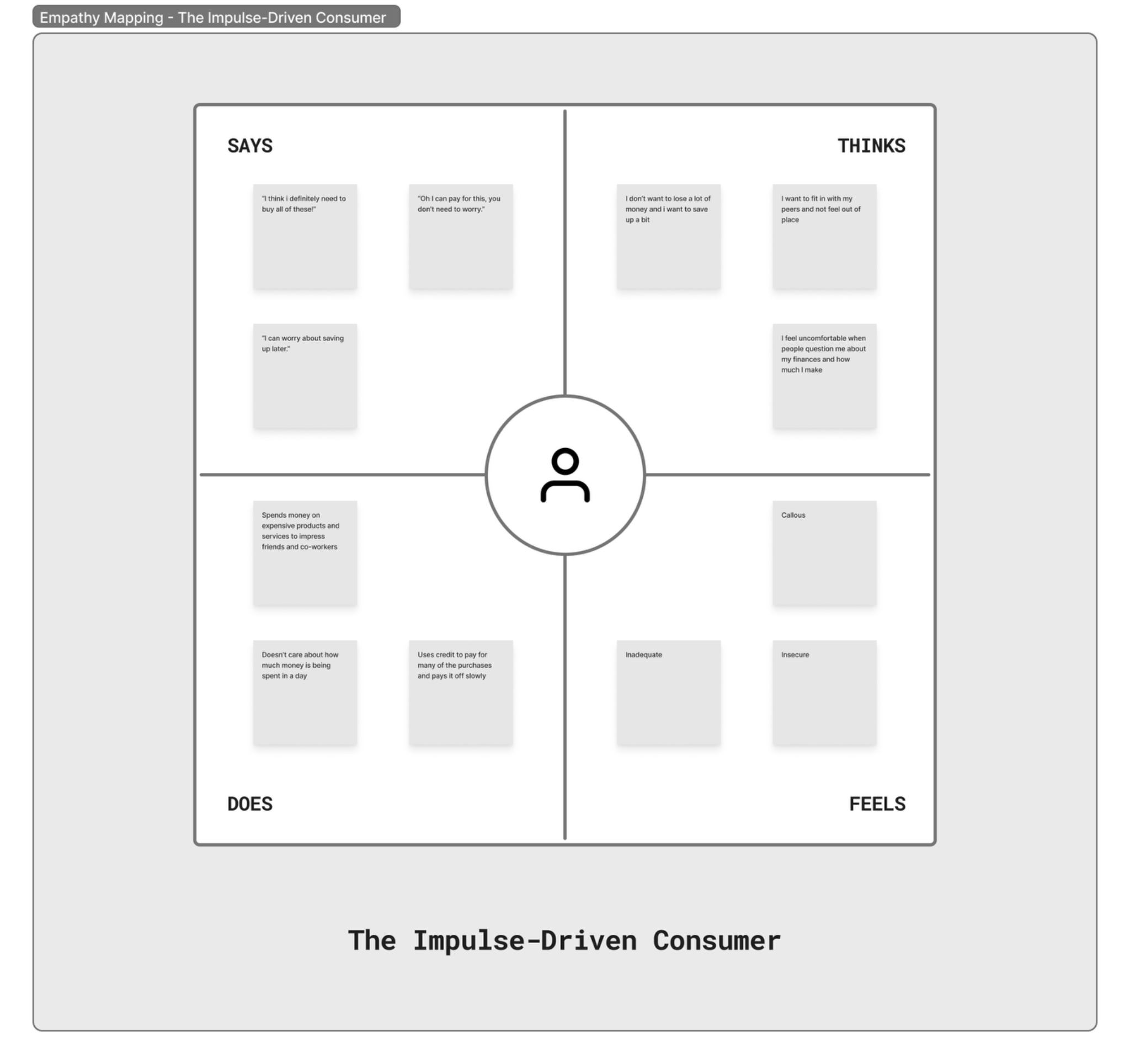

Empathy Mapping

To understand the emotional impact of understanding financial decisions, empathy maps are created:

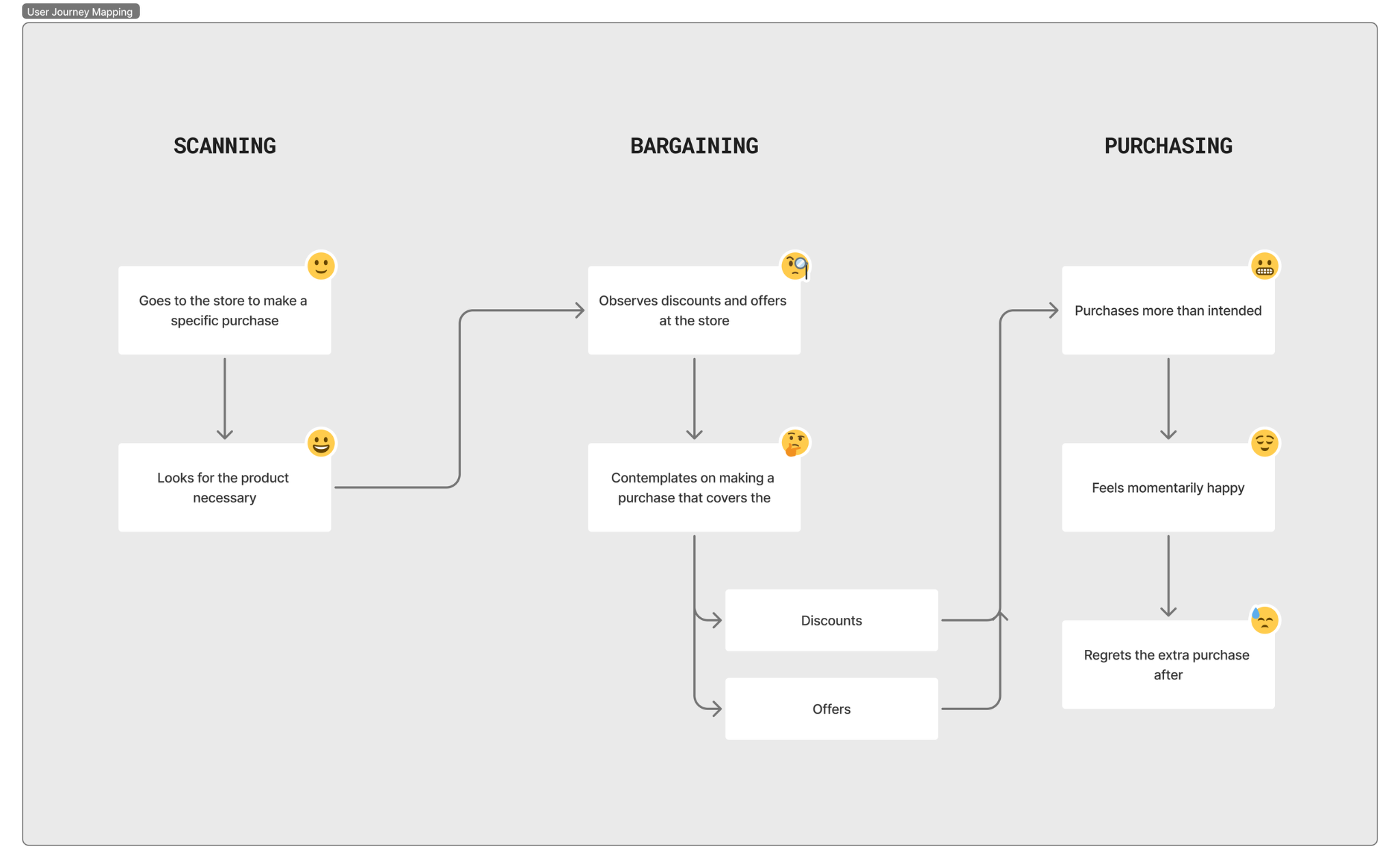

User Journey Mapping

The stages that take to make an impulsive purchase are mapped; The actions and emotions behind each step are noted down:

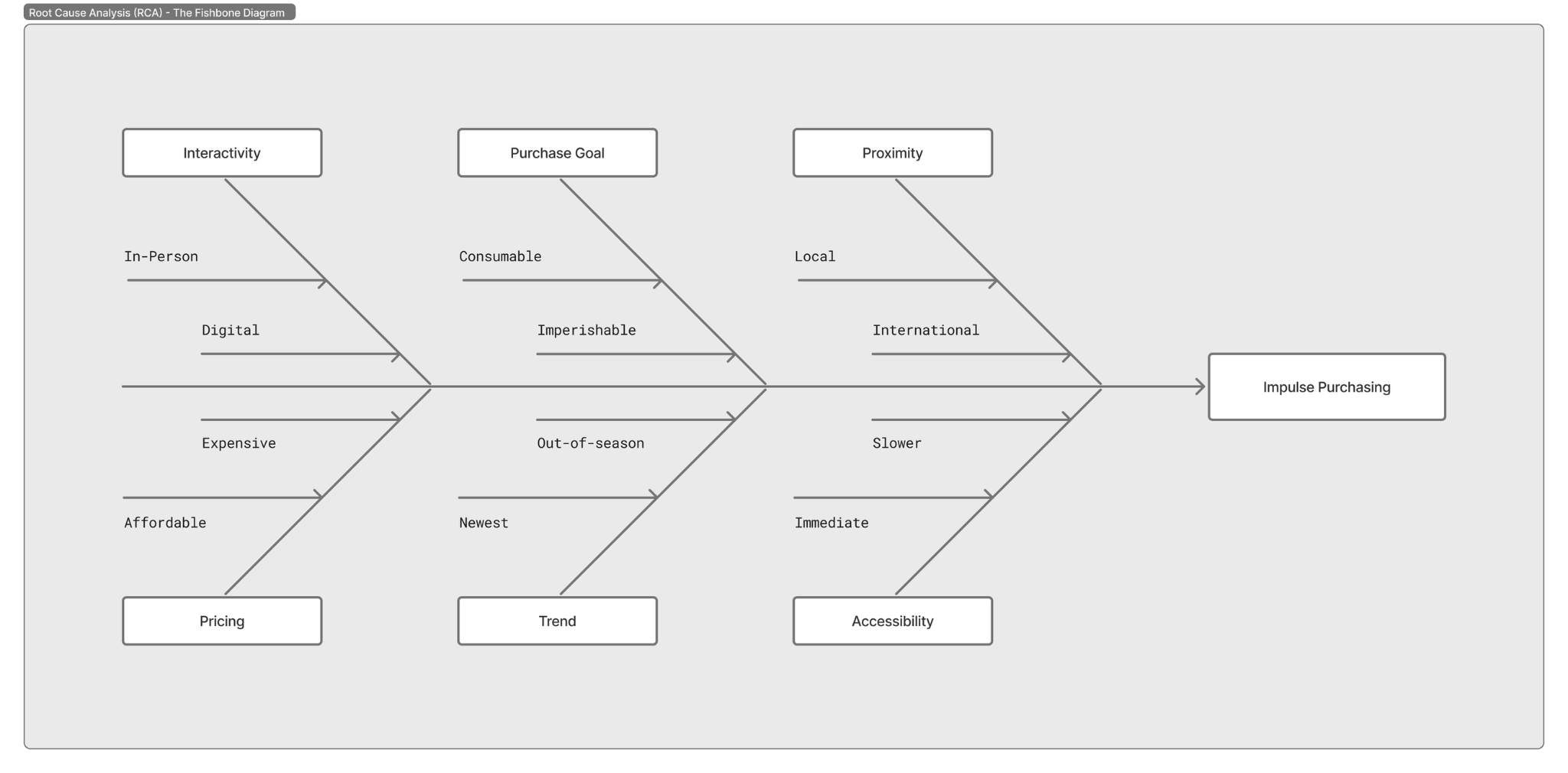

Root Cause Analysis (RCA)

The core issue being impulse purchasing, the factors that surround this phenomenon are delved into:

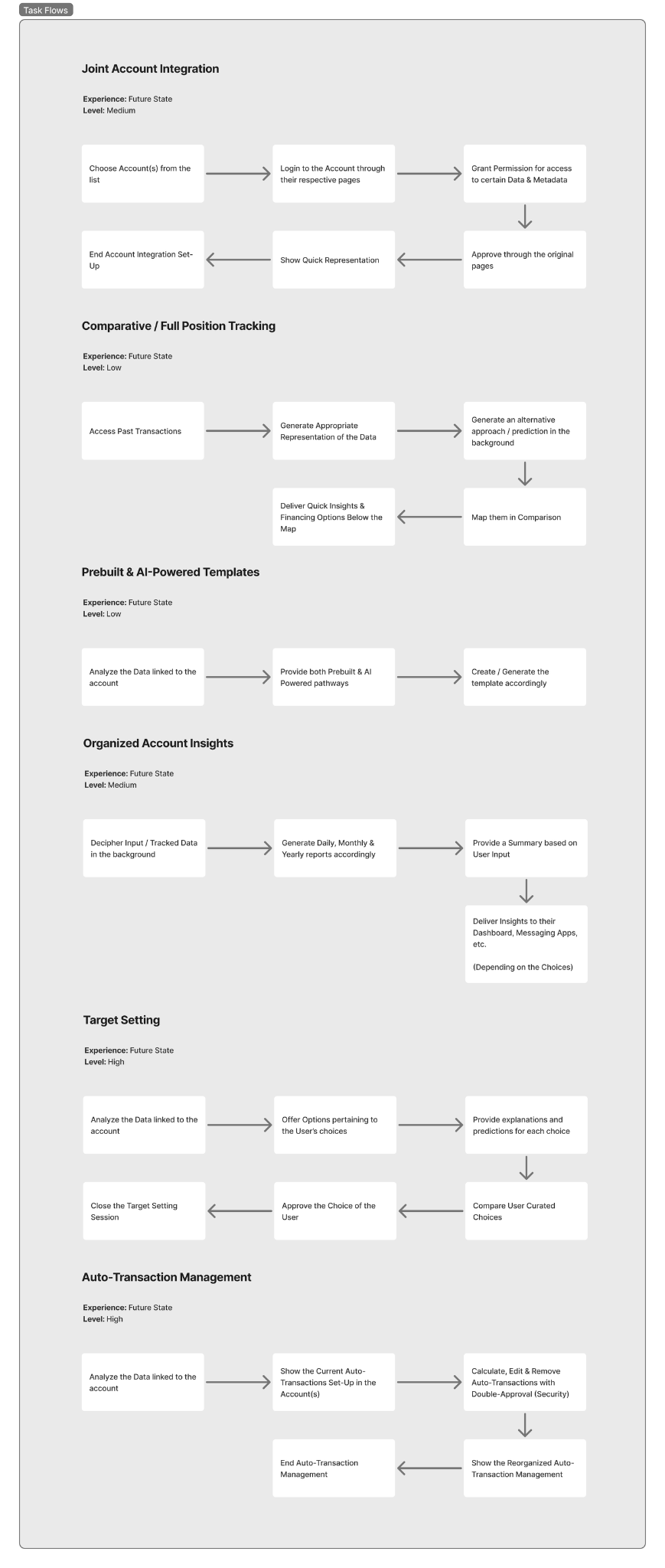

Feature Checklist

These are the features that should be worked on during the design phase.

- Joint Account Integration

- Comparative / Full Position Tracking

- Prebuilt & AI-Powered Templates

- Organised Account Insights

- Target Setting

- Auto-Transaction Management

Task Flows

Depending on the state of action and the complexity of the flow, these task flows are mapped out as follows:

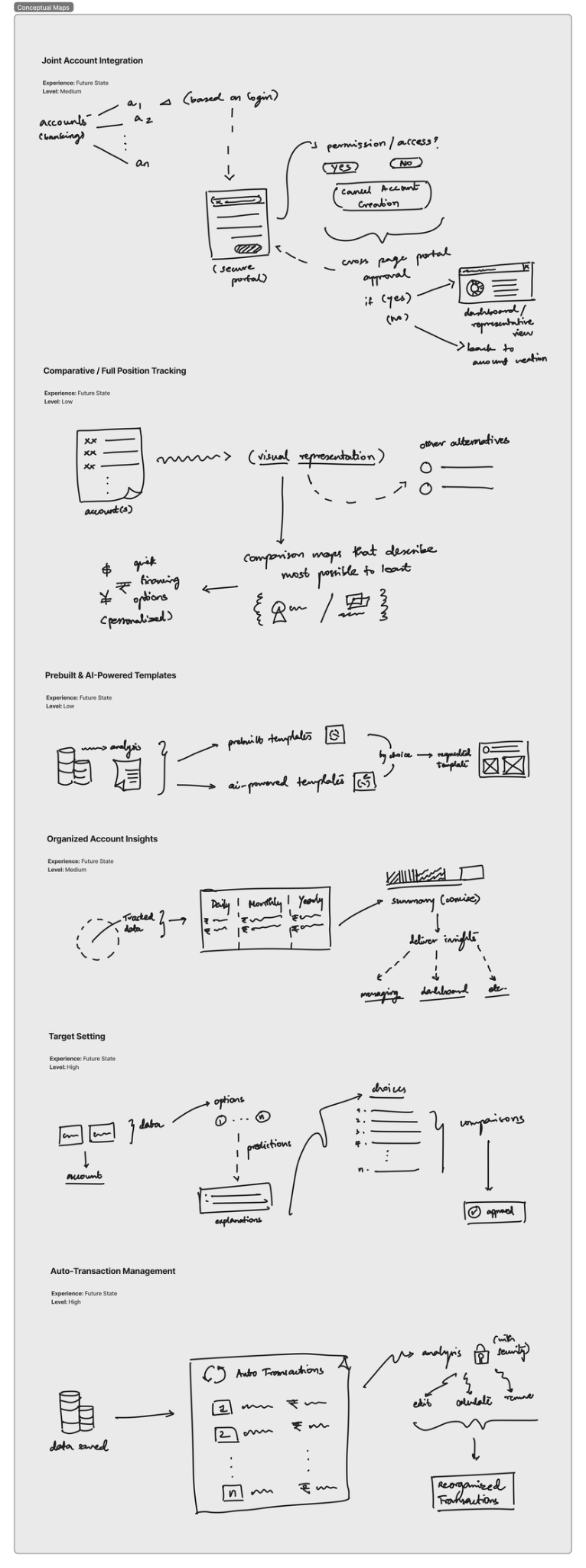

Conceptual Maps

Expanding on the task flows, the components of each interaction are listed and linked accordingly:

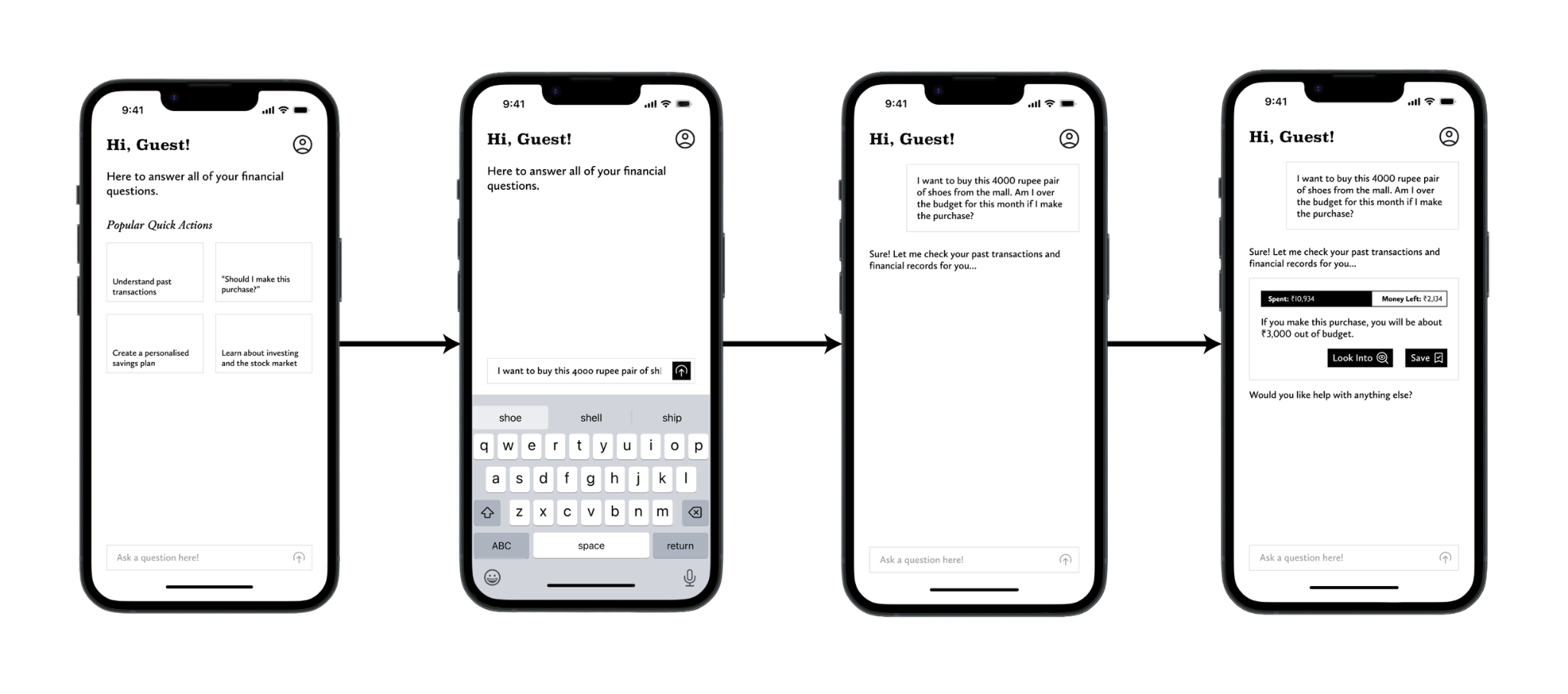

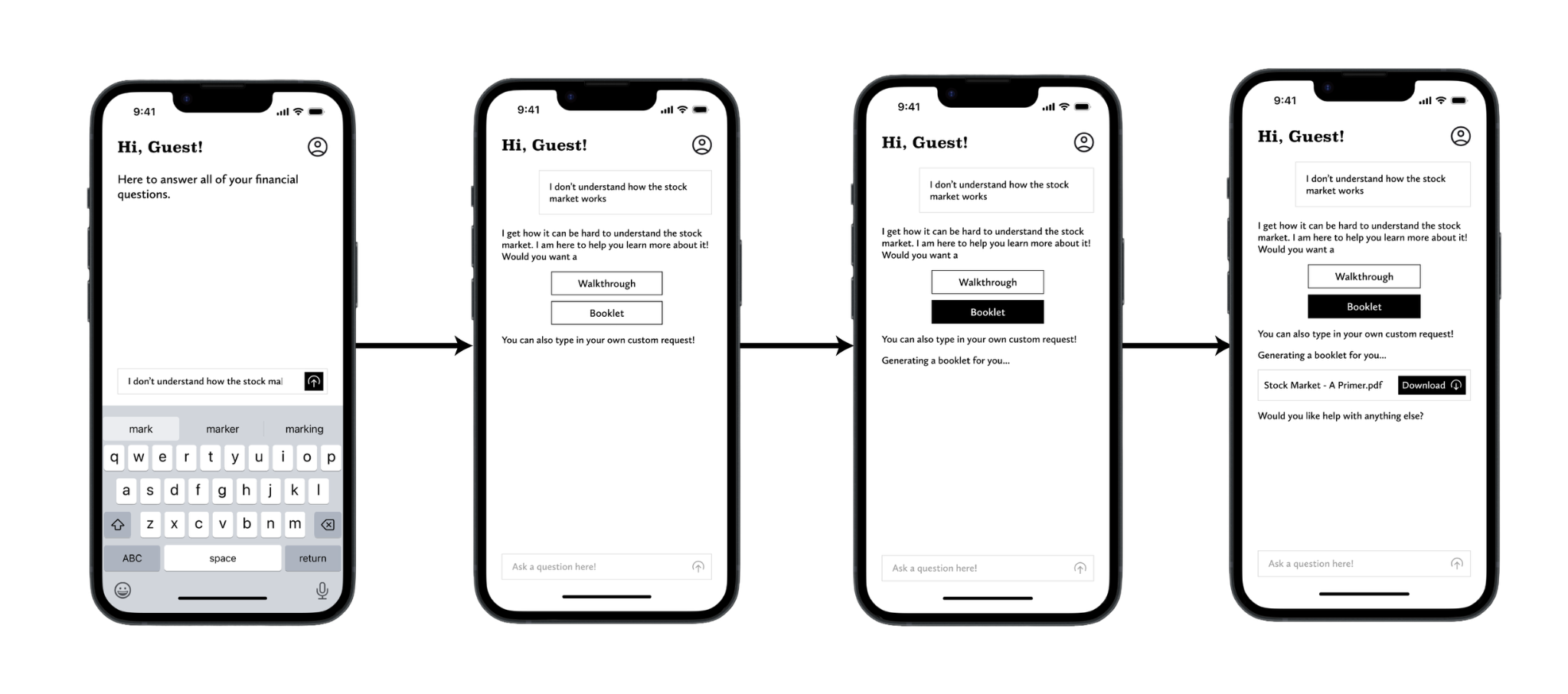

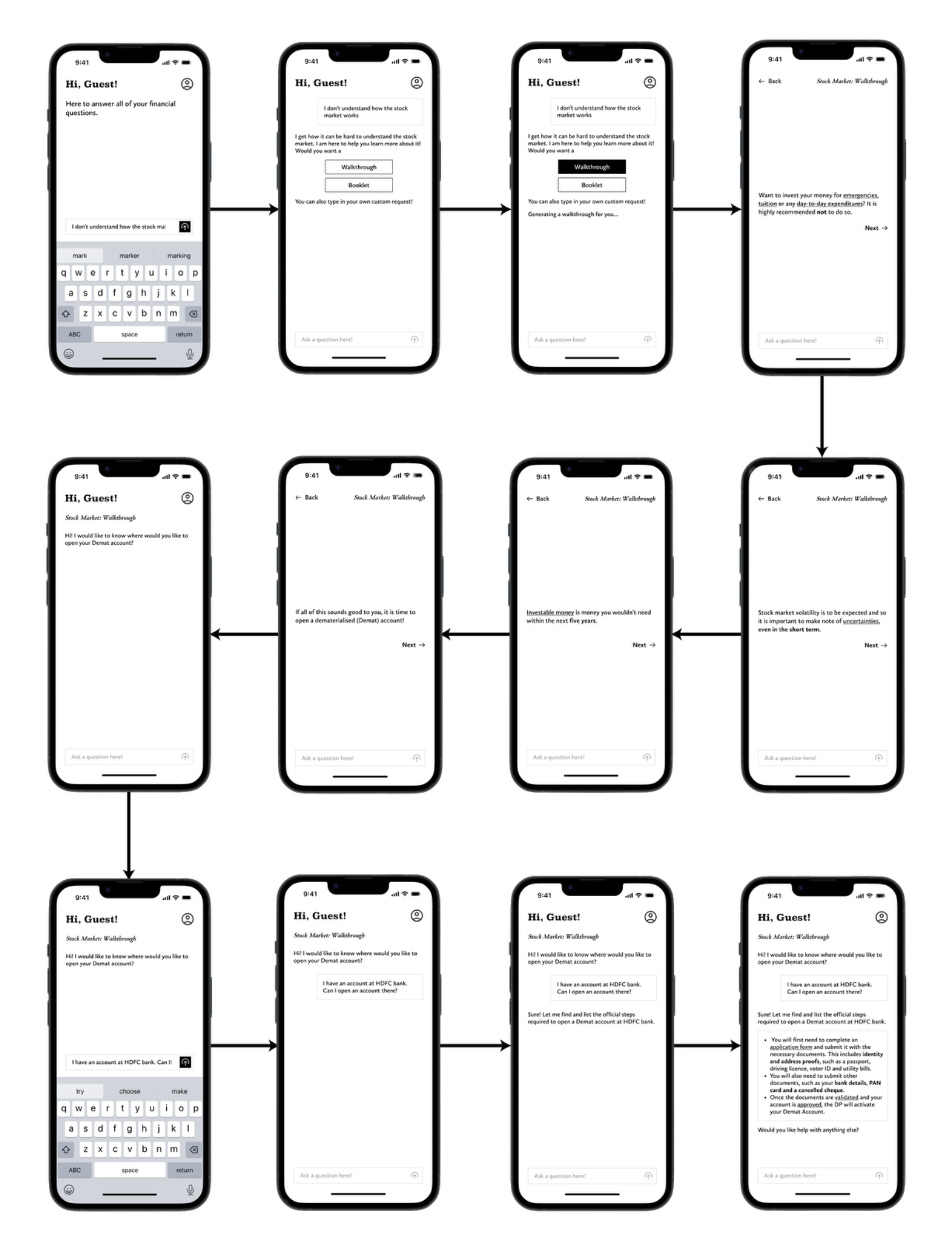

High Fidelity Wireflows

These are the screens designed based on all of the research and planning that has been done.

Shopping

Learning Choices

Post a comment